Severely restraining the ability of blacks to pay for college is the fact that, for the past 40 years, black family income has held steady at about 60 percent of median white family income. This large and unyielding gap is a huge barrier to blacks who seek education beyond high school.

A far more important statistic for measuring the ability to finance the cost of higher education is family wealth. Family assets such as stocks, bonds, money in the bank, and real estate produce interest, dividends, or rental income which are commonly used to offset or pay college costs. Wealth also includes the value of a family’s home. This important asset can be sold or borrowed against to provide funds for college expenses.

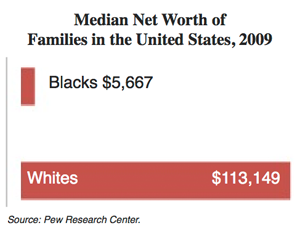

The wealth gap between black and white families has been huge. Typically, over the past generation white families have had wealth that was 10 times that of black families.

A new study from the Pew Research Center shows that during the recent recession, the wealth gap has grown even wider. In 2009 the average white family had had a median net worth of $113,149. The average black family had a median net worth of only $5,677. Since 2005 the median net worth of black families had dropped by more than 50 percent. In 2009 the average white family had a net worth that was almost 20 times greater than the median net worth of black families.

With sharp rises in tuition at many state-operated colleges and universities, the growing racial wealth gap will undoubtedly result in the inability of many black students to afford a college education.