Andrew W. Kahrl, an associate professor of history at the University of Virginia, who is affiliated with the Carter G. Woodson Institute for African American and African studies at the university, is using local tax records to document the history of racial discrimination and residential segregation in the state.

Andrew W. Kahrl, an associate professor of history at the University of Virginia, who is affiliated with the Carter G. Woodson Institute for African American and African studies at the university, is using local tax records to document the history of racial discrimination and residential segregation in the state.

Dr. Kahrl is conducting research on how tax liens and tax sales became a tool used by predatory land speculators to acquire Black-owned land. “Many of these places were legally stolen from Black people by private investors working in concert with local officials,” Dr. Kahrl found.

Dr. Kahrl discovered that local officials assessed Black property owners at highly inflated rates in an effort to tax them off the land. “This practice was pervasive,” Dr. Kahrl said. “It was something that was taking place throughout the South and it is clear that it is discriminatory in nature. African-Americans were consistently taxed higher on their property than White homeowners and landowners in the same neighborhood.”

In some states, if the Black landowners missed a tax payment, a lien would be put on the property – and the lien or the property would eventually be sold at a tax sale, where speculators could purchase the debt, add legal fees to it and eventually seize the property for much less than it was worth.

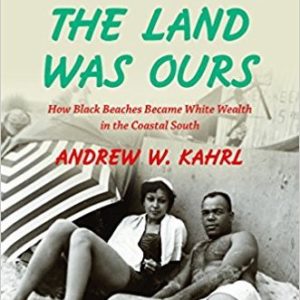

Dr. Kahrl is the author of The Land Was Ours: How Black Beaches Became White Wealth in the Coastal South (University of North Carolina Press, 2016).