In 2021, the United States Department of Housing and Urban Development launched the Interagency Task Force on Property Appraisal and Valuation Equity (PAVE), a program aimed at eliminating racial and ethnic bias in home valuations. While there has been some improvement in recent years, a new report from the National Association of Real Estate Brokers has documented the persistent disparities in the home appraisal values in Black and White neighborhoods.

In 2021, the United States Department of Housing and Urban Development launched the Interagency Task Force on Property Appraisal and Valuation Equity (PAVE), a program aimed at eliminating racial and ethnic bias in home valuations. While there has been some improvement in recent years, a new report from the National Association of Real Estate Brokers has documented the persistent disparities in the home appraisal values in Black and White neighborhoods.

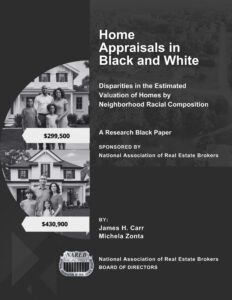

After controlling for housing quality, location, amenities, and socioeconomic characteristics, the report found Black and White neighborhoods received a median appraised home value of $299,572 and $430,915, respectively, in 2023. This is a staggering 30 percent undervaluation gap for Black homes. Despite this significant disparity, the Black-White gap in adjusted median appraised home value narrowed between 2013 and 2022. However, it widened from 2022 to 2023.

Notably, the authors found significant differences between predominately Black neighborhoods with a large share of loans to Black borrowers compared to White neighborhoods with no loans issued to Black borrowers. In 2021, the gap in appraised home value between these two types of neighborhoods was a stark 47 percent. There was no improvement in this gap by 2023.

In an examination of the top 20 metropolitan areas with the largest Black populations in 2022, the authors found improvements in some locations and declines in others. In Los Angeles, the undervaluation gap widened by 17 percent from 2021 to 2023. In contrast, the undervaluation gaps have narrowed significantly in Houston and Washington, D.C., with a 10 percent and 14 percent improvement, respectively, over the same time period.